child tax credit october payments

A child tax credit CTC is a tax credit for parents with dependent children given by various countries. Reconcile Child Tax Credit Payments.

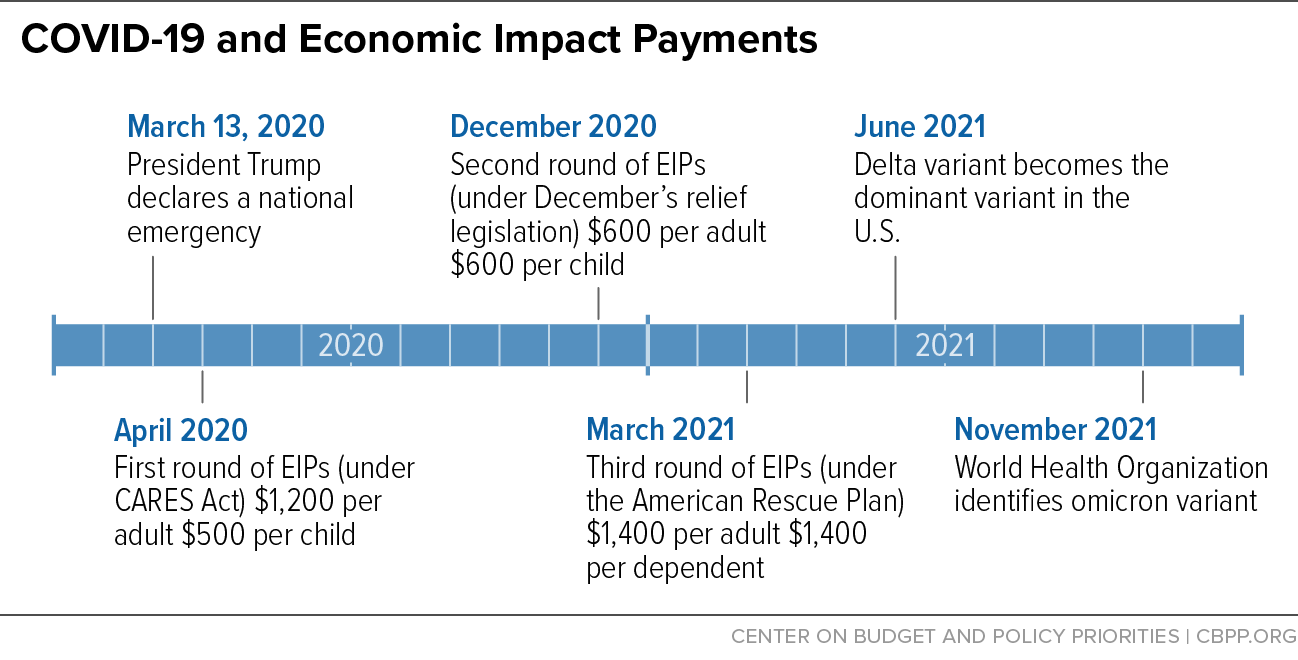

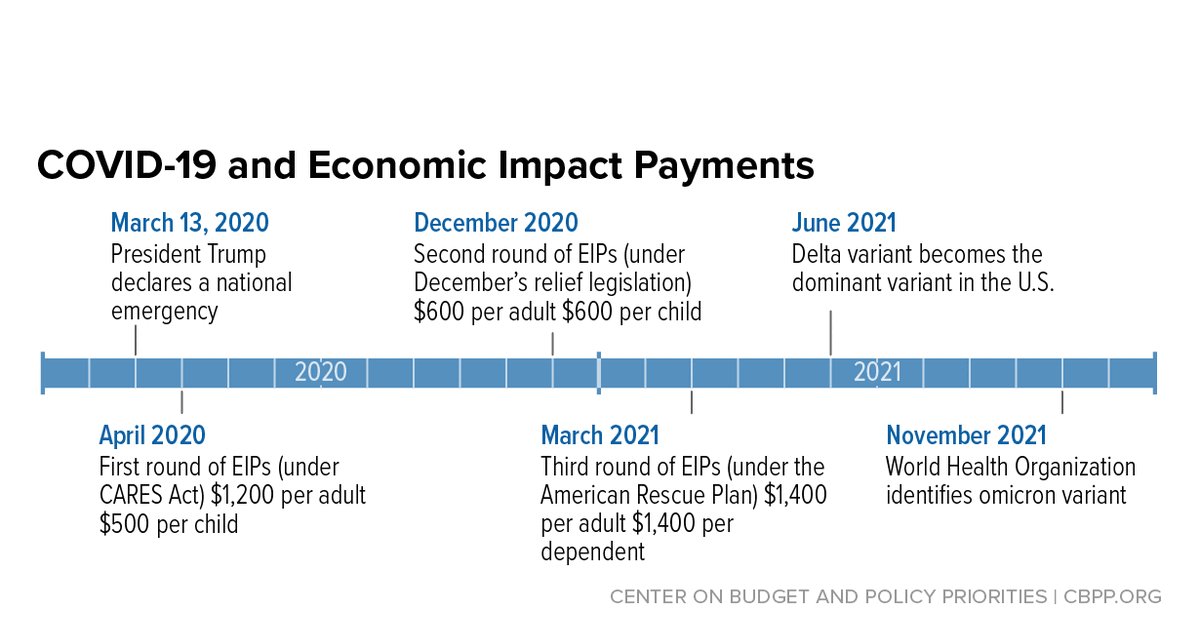

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

If you requested an extension you have until October 17 to timely file your 2021 tax return.

. For example in the United States only families making less than 400000 per year may claim the full CTCSimilarly in the United Kingdom the tax. Governor Ned Lamont signed the 2022-2023 budget bill in June which included a child tax rebate. The credit is often linked to the number of dependent children a taxpayer has and sometimes the taxpayers income level.

Special extensions apply to some disaster victims. The advance Child Tax Credit payments were signed into law as a part of the American Rescue Plan Act in 2021. The deadline for applications was July 22 and now city officials expect payments to be sent out in August or September.

When you or a family member applies for Marketplace coverage the Marketplace will estimate the amount of the premium tax credit that you may be able to claim for the tax year using information you provide about your family composition projected household income and other factors such as whether those whom you are enrolling are eligible for other. Your 2021 Tax Return. Additionally households in Connecticut can claim up to 750 under a child tax credit program as long as they apply by July 31.

If you got advance payments of the Child Tax Credit find how to reconcile the payments on your 2021 federal tax return. The tool below is to only be used to help you determine what your 2021 monthly advance payment could have been. If the bill passes.

Any advance child tax credit payments need to be reported on a 2021 IRS Tax Return.

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

How To Get Free Birth Control Via Obamacare A Walkthrough Birth Control Birth Control Methods Family Planning

Tax Worksheets Tax Deductible Expense Log Tax Deductions Etsy Happy Planner Finance Planner Printable Planner

Fillable Form 637 Application For Registration Letter Activities Employer Identification Number Small Business Tax

You Should Opt Out Of Child Tax Credit Payments If This Is Happening

Cbdt Has Extended The Due Date For Payment Of Tds Under Section 194m During September 2019 And October 2019 From Business Updates Chartered Accountant Due Date

An Extension To File Your Taxes Is Not An Extension To Pay Tax Attorney Nick Nemeth Tax Attorney Filing Taxes Tax Deadline

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Solopreneurs Entrepreneurs Get To Shelter Income Income Tax Shelter

Tax Tip Tuesday In 2022 Tax Deductions Tax Payment Federal Income Tax

Childctc The Child Tax Credit The White House

Climate Action Incentive Payments Caip For 2022 How Much Will You Get Savvynewcanadians

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Monthly Child Tax Credit Payments Begin Today Here S How Much You Can Expect Nextadvisor With Time

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Any Gain That Arises From The Sale Of A Capital Asset Is A Capital Gain This Gain Or Profit Is Comes Under Th Capital Gains Tax Capital Gain Financial Peace